Table of Contents

- Video: Roblox Stock Ipo Analysis + Bitcoin: Stock Market Bubble Update

- How To Place A Stop Loss Order

- How Do Stop Loss Orders Work?

- Focus On Daily Support And Resistance Levels

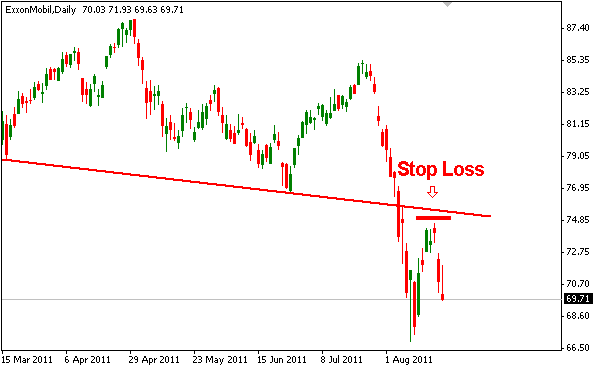

These orders help minimize the loss an investor may incur in a security position. So if you set the stop-loss order at 10% below the price at which you purchased the security, your loss will be limited to 10%. Figuring out where to place your stop-loss depends on your risk threshold—the price should minimize and limit your loss. Stopped out refers to the execution of a stop-loss order, an effective strategy for limiting potential losses.

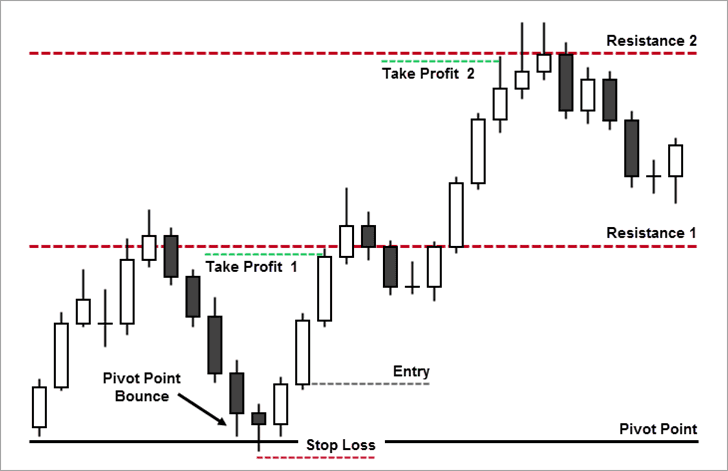

The second impulsive break could then bring price to target. So you can see here that, having a tight stop loss can minimize your trading loss, which means you do not risk a lot of your trading account in each trade.

Nevertheless, recently these programs have managed to get a lot of attention because they have become far more accurate and profitable. Even where the market maker or specialist does not have access to actual stop orders, he can predict where they are with reasonable accuracy. If we look at the earlier BHP example, the market maker can be pretty certain that there will be stop loss orders set below a 3- or 4-day low. Short-term traders keep their stops tight to protect their profits. The risk may be higher, but it is still a simple procedure to sell short and then try to shake out sufficient stops to cover your order. However, at the same time, it’s still important to stick to your strategy. So, if you’re reading this and stop-orders are part of your trading strategy, you can still do something about OTC penny stocks.

Video: Roblox Stock Ipo Analysis + Bitcoin: Stock Market Bubble Update

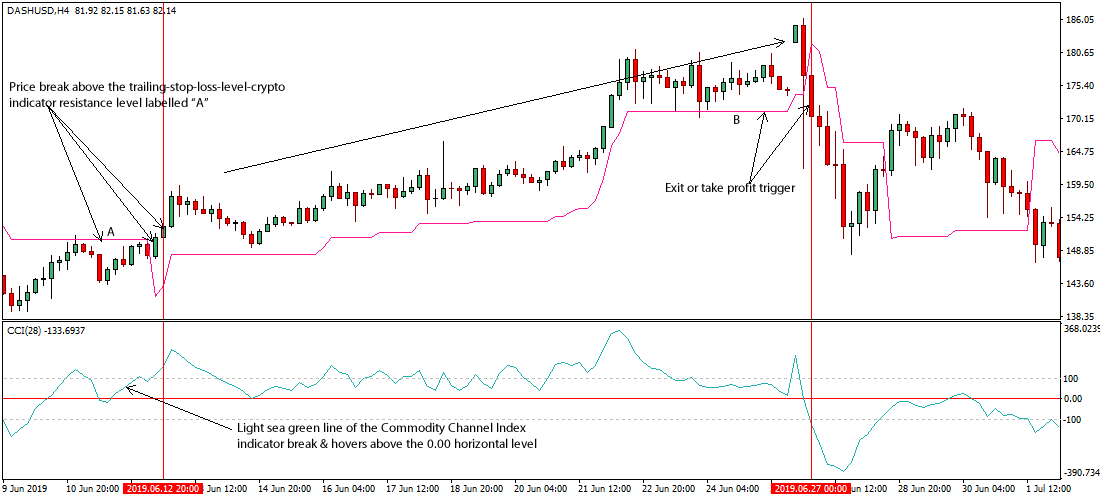

The trailing stop order sits in the market as a limit order waiting to be hit when price reaches it. When the stop is triggered, the stop loss order now acts like a market order which means you could get filled at a worse price than your stop order. You may have not lost a lot money, but you were in a winning trade that your stop-loss kicked you out of early. At the end of the day, keep things like this in mind and if anything, paper trade to get more comfortable with this first. While stop-losses are designed to mitigate loss, there is a situation where they miss. If a stock gaps down below your stop-loss, it will trigger the order but at the gap down price.

- The first question is whether stop losses effectively reduce large losses for options sellers.

- In this case, you will need to actively monitor your positions.

- For example, a short put sold for $5 will be closed when the profits are $250.

- It keeps you from chasing stocks after their move is already well in progress, and makes you get in at the beginning of the move instead of the end of one.

As you begin to understand how you react to the market (emotions, fears, greed, etc.) you will begin to see that these hard fast rules can hurt as much as help. After the stock took out the previous day’s high, in my mind the move had started, so I placed my stop loss order directly below the last swing low as illustrated. After entering the trade, Tesla began to move sideways for a number of days. There was a clean base which formed and as the stock dragged lower, there were three successive moves down which pushed the stock lower. You can see these swing points in the below 30-minute chart.

How To Place A Stop Loss Order

I recently changed my main trading system after testing a new one for over a year. As seen in “Stop Loss with Profit Taking Performance,” below, adding a proactive profit-taking strategy drastically improves the performance of all six management strategies. Loosening the stop loss increases the win rate and ROC but ultimately defeats the point of incorporating a stop loss because losses are similar to just holding to expiration. Let’s test the performance of varying stop losses by using the same back-testing framework used in the Basic and Intermediate articles of this Tactics series. By using this way, stop-losses are placed just below a longer-term moving average price rather than shorter-term prices. A stop-loss order is placed with a broker to sell securities when they reach a specific price. A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction.

As the moving average changes direction, dropping below 2 p.m., it’s time to tighten your trailing stop spread . As the price pushed steadily toward $92, it was time to tighten the stop. When the last price reached $91.97, the trailing stop was tightened to $0,25 cents from $0.40. The price dipped to $91.48 on small profit-taking, and all shares were sold at an average price of $91.70. Any further price increases will mean further minimizing potential losses with each upward price tick. The added protection is that the trailing stop will only move up, where, during market hours, the trailing feature will consistently recalculate the stop’s trigger point. Any trader out there who has been around the block for any significant period will tell you that trade entry and trade management go together to form a successful long-term trading approach.

The market will rarely just go to a resistance point and then reverse on the penny, or support and then bounce. You always want to give them some wiggle room around these levels, give them one five minute candle worth of range from that level.

How Do Stop Loss Orders Work?

As in the previous two studies, this analysis examines the annualized return on capital , win rate and largest loss of each management strategy. The annualized ROC explains how much return a trader can expect to make for a given amount of capital deployed. Win rate describes the portion of trades that were profitable, and the largest loss is a measure of risk that highlights the worst performing trade’s P&L. Parts I and II in this series made the case for stop losses in options trading … and stop profits. To use stops well, it’s critical to understand how to determine the optimal stop-loss level.

The phrase “stop-loss order” is misleading because of the word “loss.” However, they can also be used to protect profit. If you set hard limits, you can potentially take profits before the stock comes back down. The idea of “trading on the way up” leverages stop-losses to secure gains.

Focus On Daily Support And Resistance Levels

As seen in “Stop-Loss Performance,” (pg. 62) all of the stop losses reduced the largest loss when compared to holding the trade to expiration. More surprising, however, are the changes in the ROC and the win rate. Although incorporating stop losses reduced the largest losses when compared to holding to expiration, it did so at the expense of a lower ROC and win rate.

If the stoploss is on exchange it means a stoploss limit order is placed on the exchange immediately after buy order happens successfully. This will protect you against sudden crashes in market as the order will be in the queue immediately and if market goes down then the order has more chance of being fulfilled. It would be wonderful if there was a perfect stop loss and perfect profit target out there to use. Nevertheless, hopefully you learnt something about backtesting. Likewise, the profit target should only be used to lock in gains if an investor believes his original thesis has been proved correct or if there has been a change in that trade thesis. For example, Sell BHP if more than 10,000 shares are sold at/below $31.75.

You’re likely reading that heading and questioning everything else you read. But the fact remains, stop losses carry their own set of risks. They grow exponentially the lower in price a specific penny stock trades. While it’s true that stop-losses can make your life much easier as a part-time trader, some stocks don’t allow certain buy or sell options. Because of volatility, higher risk, and other specifics, most brokerages won’t allow stop-loss orders for OTC penny stocks. In this case, you will need to actively monitor your positions.

In practice, they give the trader an ability to pre-plan a hasty exit from a position under duress. Potentially significant slippage is once again a concern, as it is with traditional market orders. Like the stop limit, the stop market rests at market until price hits the predetermined level. Upon election, it’s filled at the best available price, as per the market order. This is a useful feature because it guarantees the closure of an open position. To illustrate, assume that Archer the crude oil trader is long one lot of July WTI crude oil from $58.06. To protect the open position, Archer places a stop limit order at $57.84 with a defined offset of 1.

How To Effectively Use A Wide Stop Loss

Same type of entry and as the ATR moves up with price, you’d adjust your stop at the ATR value at the close of the chart period you are using. There will be times where the “balloon effect” of the bands happen as we see in the middle. We would not lower our stop and it would remain the same until the band rises above it’s previous high point. You’d note the change in the price of the lower band and adjust your stop accordingly.

This does not mean 50% of your position is closed, but an entire liquidation. The assumption of immediate switching between stocks and the risk-free rate, ignoring settlement delays, may be material to findings, especially for tight stops .

As share price increases, the trailing stop will surpass the fixed stop-loss, rendering it redundant or obsolete. On all your trades, you have to imagine at what price point does your thesis become invalid.

As we probe deeper into the topic you will receive a compelling argument on both sides. One point of view that stop loss orders are a good idea, the other that if used incorrectly, this capital preservation technique could have the exact opposite effect on your equity curve. When you think of a stop loss order, you should get a visual of a defeated soldier waving a white flag on the battle field. It is a complete concession that your original plan was wrong. Build your Forex trading strategies using a visual programming environment without writing any code. Setting a stop on binance.Always set your LIMIT sell order slightly under your STOP order, otherwise the market might ignore you and not give you a fill.

In order to understand how to place a trailing stop, you should know the different between a trailing stop and a static stop. You can set an automatic trailing stop with Forex brokers such as Oanda which will update your stop according to your criteria. When price rises, the stop will follow using the technique you have chosen. I am going to list several methods to trail your stop loss, difference between stop loss and stop limit orders, and how they work.

You don’t want to set your stop loss at the market structure directly since you will be “stop hunted” very easily. As you can see… if you placed a stop order below the prior pivot, you would have been out of your long trade just to watch the market move without you. You see, there are some strategies that you can apply to improve how and where you place your stops. It’s a rules-based approach that I believe can save you a lot of money if you just hear me out. If you want to join us for weekly live analysis, trade ideas and daily market updates – you shouldsign up for one of our TRADEPRO Subscriptions here.

You should carefully consider if engaging in such activity is suitable to your own financial situation. TRADEPRO Academy is not responsible for any liabilities arising as a result of your market involvement or individual trade activities.

Where should I set a stop loss?

Once you have inserted the moving average, all you have to do is set your stop loss just below the level of the moving average. For instance, if you own a stock that is currently trading at $50 and the moving average is at $46, you should set your stop loss just below $46.

Many traders adjust their stop loss strategies according to how risky they believe the trade to be. If you have good reason to believe a trade will continue in the direction you desire, it doesn’t make sense to use a tight stop loss. Instead, you should opt for a little breathing room for your trade.

We could delay the exit so that it takes place on the close or on the next bar open . However, this kind of takes away the point of using stops in the first place. In fact, delaying the entry to the next bar open results in the optimal parameters changing from a 5% profit target to a 35% profit target and a 45% stop loss to a 70% stop loss. To compound matters, these new settings produce a return-to-risk score of only 0.13 which is not good enough to trade. We could use unadjusted data so that we trade only at price levels that were true in the past.